Understanding Home Equity Lines of Credit (HELOC)

Home equity lines of credit, or HELOCs, have become increasingly popular financing options in recent years. These revolving credit lines allow homeowners to borrow against the equity they’ve built in their homes, providing a flexible source of funds for various purposes. PNC Bank, a leading financial institution with a strong presence nationwide, offers a robust HELOC program that can potentially cater to a wide range of borrowers’ needs. This comprehensive guide explores the nuances of PNC Bank HELOCs, covering their features, eligibility requirements, benefits, drawbacks, and factors to consider before taking the plunge.

What is a HELOC?

A HELOC is a type of secured loan where your home serves as collateral. Unlike a traditional home equity loan, which provides a lump sum disbursement, a HELOC functions more like a credit card. It offers a revolving line of credit that you can draw upon as needed, making it a flexible financing option for various needs.

How Does a HELOC Work?

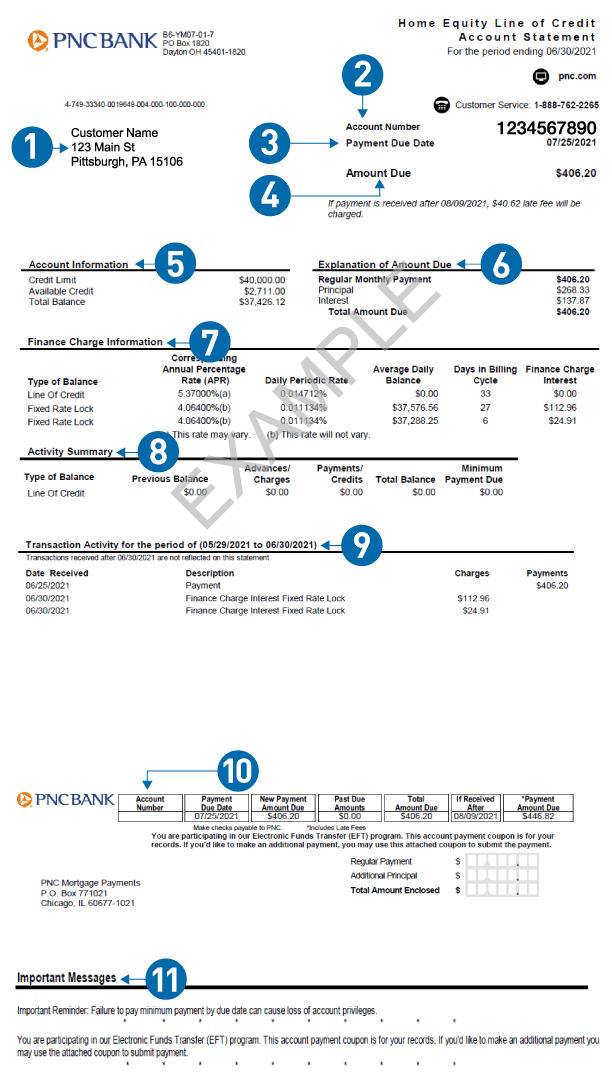

HELOCs typically have two phases: the draw period and the repayment period. During the draw period, which usually lasts 10 years, you can access funds from your HELOC as needed. You only have to pay interest on the amount you borrow during this time. Once the draw period ends, you enter the repayment period, where you make monthly payments on the outstanding balance. This period can last up to 20 years, depending on the terms of your HELOC.

Advantages of a HELOC

One of the biggest advantages of a HELOC is its flexibility. Unlike a traditional loan, you don’t have to use the entire amount at once, and you only pay interest on the portion you use. This feature makes a HELOC an ideal choice for financing home renovations, debt consolidation, or unexpected expenses.

Another advantage of a HELOC is the potential tax benefits. In most cases, the interest paid on a HELOC is tax-deductible, making it an attractive financing option for homeowners.

Key Features and Benefits of PNC Bank HELOC

PNC Bank offers a variety of HELOC options to cater to different borrowers’ needs. Here are some of the key features and benefits of PNC Bank HELOCs:

Competitive Interest Rates

One of the most significant factors borrowers consider when choosing a HELOC is the interest rate. PNC Bank offers competitive variable interest rates for its HELOCs, which are tied to the prime rate, allowing for potential rate decreases in the future.

No Application or Annual Fees

Many lenders charge application fees and annual maintenance fees for HELOCs. However, PNC Bank does not have any application or annual fees for its HELOCs, making it a cost-effective option for borrowers.

Flexible Disbursement Options

PNC Bank offers multiple ways to access funds from your HELOC. You can choose between online transfers, checks, or a Visa® Equity Access Card® linked to your HELOC account.

Additional Discounts for PNC Customers

If you already have a PNC checking account and make monthly payments from it towards your HELOC, you may qualify for an interest rate discount. Plus, PNC Bank also offers discounts for setting up automatic payments from a PNC checking account.

Generous Credit Limits

The maximum credit limit for a PNC Bank HELOC varies depending on factors such as your credit score, income, and the available equity in your home. However, PNC Bank typically offers credit limits of up to 85% of your home’s value.

Eligibility Requirements and Application Process

Before applying for a PNC Bank HELOC, you must meet certain eligibility requirements, including:

- A minimum credit score of 620

- A debt-to-income ratio of 43% or less

- A loan-to-value ratio of 80% or less

The application process for a PNC Bank HELOC is relatively simple. You can apply online, over the phone, or in-person at a PNC Bank branch. The bank will review your credit score, income, and home value to determine your eligibility and credit limit. Additionally, you may be required to provide documentation such as tax returns, pay stubs, and proof of homeowners’ insurance.

Comparing PNC Bank HELOC with Other Financial Institutions

As with any financial product, it’s essential to compare different HELOC options before making a decision. Here’s how PNC Bank HELOCs stack up against other financial institutions:

| Bank Name | Interest Rates (APR) | Minimum Credit Score | Maximum Loan Amount |

|---|---|---|---|

| PNC Bank | As low as 3.49%* | 620 | Up to 85% of home value |

| Wells Fargo | As low as 4.25%* | 620 | Up to 85% of home value |

| Chase | As low as 4.50%* | 680 | Up to 80% of home value |

*Interest rates as of September 2021 and subject to change.

While PNC Bank offers comparatively lower interest rates and more flexible credit limits, it’s always a good idea to shop around and compare offers from different lenders to find the best deal.

Strategies for Effectively Using a HELOC

A HELOC can be a powerful financial tool, but it’s crucial to use it responsibly to avoid getting into debt. Here are some strategies to make the most out of your PNC Bank HELOC:

Use it for Home Improvements

One of the most common uses of a HELOC is financing home renovations. If you’re planning to make improvements that can increase your home’s value, such as a kitchen remodel or a new roof, using a HELOC can be an excellent way to fund it.

Consolidate High-Interest Debt

If you have multiple high-interest debts, such as credit card balances or personal loans, consolidating them into a HELOC can potentially save you money on interest. Plus, with flexible repayment options, you can pay off the debt at your own pace without being locked into a fixed payment schedule.

Keep an Emergency Fund

A HELOC can also serve as an emergency fund for unexpected expenses, such as medical bills or car repairs. Instead of using high-interest credit cards or taking out a personal loan in an emergency, you can tap into your HELOC and pay it back at a lower interest rate.

Potential Risks and Considerations

While a HELOC can offer many benefits, it’s essential to understand the potential risks and factors to consider before taking one out:

Risk of Foreclosure

Since your home serves as collateral for a HELOC, defaulting on payments can put your home at risk of foreclosure. It’s crucial to carefully assess your financial situation and make sure you can comfortably make the monthly payments before taking out a HELOC.

Variable Interest Rates

Unlike traditional loans, HELOCs usually have variable interest rates that can fluctuate with market conditions. While this can work in your favor if interest rates decrease, they can also increase, resulting in higher monthly payments.

Additional Fees and Charges

In addition to interest, lenders may charge other fees, such as appraisal fees, annual maintenance fees, or inactivity fees. Make sure to read the fine print and understand all the fees associated with a HELOC before signing up.

Conclusion

A HELOC can provide homeowners with a flexible source of funds for various needs. PNC Bank offers a competitive HELOC program with features such as no application or annual fees, flexible disbursement options, and generous credit limits. However, it’s essential to carefully consider the potential risks and factors to ensure a HELOC is the right financial choice for your specific needs. With proper research and responsible use, a PNC Bank HELOC can be an excellent tool for unlocking your home’s equity.